This is a crucial consideration for businesses that prioritize cash flow management. Improved cash flow can provide more flexibility for capital expenditures, debt repayment, and other strategic initiatives. By using this method, ABC Ltd. accounts for these increased costs in its inventory valuation. The company values its ending inventory at the current, higher market prices.

Effective Cash Book Management for Modern Finance

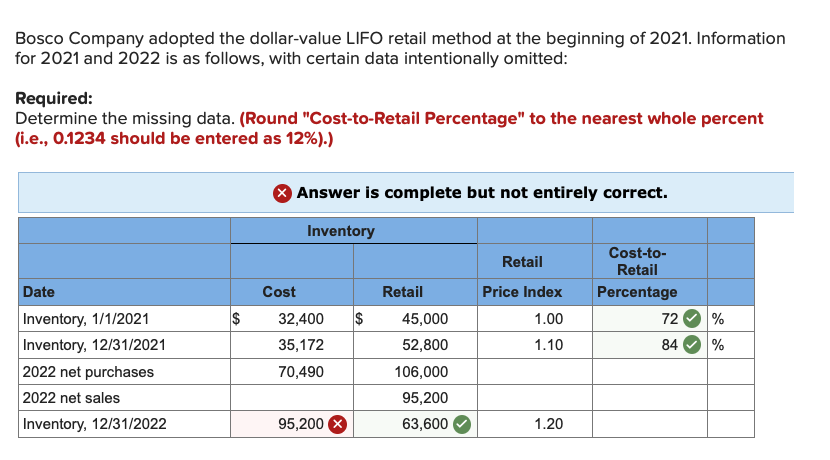

- The price index is a crucial part of the Dollar Value LIFO method that helps account for inflation when calculating the worth of inventory.

- When calculating the dollar value of the inventory, all items within the same pool are considered collectively, rather than individually.

- This approach is not commonly used to derive inventory valuations, for several reasons.

- The Financial Accounting Standards Board (FASB) has been active in updating guidelines to enhance transparency and comparability in financial reporting.

An inventory pool is the compilation of similar items in the Dollar Value LIFO method. These pools are created to simplify the calculation process by considering a cluster of items, rather than distinct individual items. In Year 2, the incremental amount of cell phone batteries added to stock is 1,500 units.

AccountingTools

However, remember, the chosen base year doesn’t influence the dollar value of the inventory; it’s only a point of reference. (ii) in the case of a cessation of such an election, the 1st taxable year after such election ceases to apply. (B) the adjustment for each such separate pool is based on the change from the preceding taxable year in the component of such index for the major category. This however, was solved with a workaround called LIFO reserve or LIFO Allowance. Another major issue with LIFO is delayering or better known as LIFO liquidation or erosion.

Dollar Value LIFO Definition Becker

The property tax calculator and how property tax works method is a variation on the last in, first out cost layering concept. In essence, the method aggregates cost information for large amounts of inventory, so that individual cost layers do not need to be compiled for each item of inventory. Under the dollar-value LIFO method, the basic approach is to calculate a conversion price index that is based on a comparison of the year-end inventory to the base year cost. The focus in this calculation is on dollar amounts, rather than units of inventory.

Dollar-Value LIFO Method Calculation

Bear in mind, while the Dollar Value LIFO method can efficiently manage a large inventory subjected to price level changes, it may not be suitable for all industries. Therefore, it’s always essential to consider the unique needs and resources of your business before opting for any valuation method. Finally, compare the converted ending inventory with the previous year’s ending inventory to compute any increase.

The Financial Accounting Standards Board (FASB) has been active in updating guidelines to enhance transparency and comparability in financial reporting. One significant update is the increased emphasis on disclosure requirements. Companies are now required to provide more detailed information about their inventory valuation methods, including the rationale behind choosing Dollar-Value LIFO and its impact on financial statements.

Purchased goods’ prices are rising, making their worth more than their base prices. Dollar Value LIFO would mean that the recently purchased (more expensive) goods are reported as sold first. Consequently, the cost of goods sold (COGS) reported is higher, and the company’s taxable income is lower than what it would have been with FIFO (First-in, First-out).

This method requires extensive record-keeping and complex calculations due to fluctuating inventory values. It can lead to significant variances in financial statements, especially in volatile pricing periods, potentially complicating performance assessments for investors. The selection of a base year involves some subjectivity, which could affect financial reporting reliability.

Recent comments