Similarly, If a competitor starts offering big discounts, your projected sales might drop and may cause you to miss your break-even point. Once you’ve determined your break-even point, you’ll be able easily view how many products you need to sell and how much you’ll need to sell them for in order to be profitable. If you won’t be able to reach the break-even point based on the current price, it may be an indicator that you need to increase it. This is beneficial for businesses that have been selling the same product at the same price point for years or businesses that are just beginning and are unsure of how to price their product. Changes in pricing of your products can affect your break-even point.

Price to Sales Ratio Calculator

To further understand the break-even point calculation, check out a few examples below. Let’s show a couple of examples of how to calculate the break-even point. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. So to break even, Maria needs to create and sell eight quilts a month. If she wants to turn a profit, she’ll need to sell at least nine quilts a month. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience.

Relationships Between Fixed Costs, Variable Costs, Price, and Volume

If the stock is trading at a market price of $170, for example, the trader has a profit of $6 (breakeven of $176 minus the current market price of $170). Assume an investor pays a $4 premium for a Meta (formerly Facebook) put option present value of future benefits with a $180 strike price. That allows the put buyer to sell 100 shares of Meta stock (META) at $180 per share until the option’s expiration date. The put position’s breakeven price is $180 minus the $4 premium, or $176.

- You can use the break-even point to find the number of sales you need to make to completely cover your expenses and start making profit.

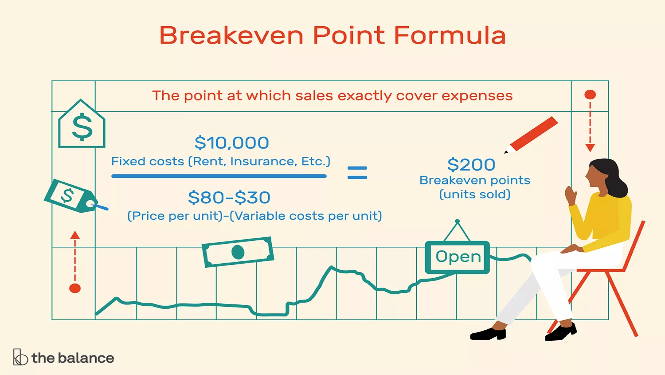

- Once you know the fixed and variable costs for the product your business produces or a good approximation of them, you can use that information to calculate your company’s breakeven point.

- In other words, you should figure out if the business is worth it.

- The Break Even Revenue Calculator is a vital tool for understanding how much revenue you need to generate in order to cover your operating expenses.

Return on Expectations Calculator

Ideally, you should conduct this financial analysis before you start a business so you have a good idea of the risk involved. In other words, you should figure out if the business is worth it. Existing businesses should conduct this analysis before launching a new product or service to determine whether or not the potential profit is worth the startup costs. As you increase your sales price, your break-even point decreases.

Analysis

This is the most obvious benefit and the goal of the break-even analysis. It can show you how many units you need to sell to break-even, or show no profit and no loss. It’s an important tool to compute your sales price, variable costs, and total fixed costs for a new product or service launch. The formula can also help you determine whether your sales price and projected units sold are enough to generate a reasonable profit. Once you’re above the break-even point, every additional unit you sell increases profit by the amount of the unit contribution margin. This is the amount each unit contributes to paying off fixed costs and increasing profits, and it’s the denominator of the break-even analysis formula.

Calculating The Break-Even Point in Sales Dollars

Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

If sales drop, then you may risk not selling enough to meet your breakeven point. In the example of XYZ Corporation, you might not sell the 50,000 units necessary to break even. In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable. The selling price is $15 per pizza, and the monthly sales are 1,500 pizzas. Additionally, the following information for a month is available.

Thus, you’re neither earning nor losing money; you’re breaking even. It also means that your company’s product or service is bringing in the amount of money needed to run your business. The break-even point is a crucial financial milestone that signifies the point at which a company’s total revenues equal its total expenses, resulting in neither profit nor loss. To find your break-even point, divide your fixed costs by your contribution margin ratio.

Recall, fixed costs are independent of the sales volume for the given period, and include costs such as the monthly rent, the base employee salaries, and insurance. When you decrease your variable costs per unit, it takes fewer units to break even. In this case, you would need to sell 150 units (instead of 240 units) to break even. When your company reaches a break-even point, your total sales equal your total expenses. This means that you’re bringing in the same amount of money you need to cover all of your expenses and run your business.

Determine the break-even point in sales by finding your contribution margin ratio. Once you calculate your break-even point, you can determine how many products you need to manufacture and sell to make your business profitable. The break-even point (BEP) is the amount of product or service sales a business needs to make to begin earning more than you spend. You measure the break-even point in units of product or sales of services. The break-even point is the number of units that you must sell in order to make a profit of zero. You can use this calculator to determine the number of units required to break even.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. At that breakeven price, the homeowner would exactly break even, neither making nor losing any money. In effect, the insights derived from performing break-even analysis enables a company’s management team to set more concrete sales goals since a specific number to target was determined. An unprofitable business eventually runs out of cash on hand, and its operations can no longer be sustained (e.g., compensating employees, purchasing inventory, paying office rent on time).

Recent comments