There should be an explanation for any discrepancies, allowing auditors to easily review financial reports during audits. Not only that, automating your reconciliation allows you to have complete assurance that all statements can be accurate. By enabling staff and clients to work in secure virtual environments, businesses can facilitate better data-sharing efficiency and open additional channels for ongoing communication. Ultimately, this helps an organization maintain its budget constraints and promote better transparency between departments for more efficient business operations. The Company uses net leverage and Net Debt to evaluate the Company’s liquidity.

Would you prefer to work with a financial professional remotely or in-person?

Integration with accounting software like NetSuite, QuickBooks, Xero, or Sage, especially when paired with Ramp, can be a significant step toward streamlining your financial operations. Account reconciliation is a vital process that helps businesses maintain their financial health by identifying errors, preventing fraud, and ensuring the validity and accuracy of all financial statements. Intercompany taxable income reconciliation is a process that occurs between units, divisions, or subsidiaries of the same parent company. This type of reconciliation involves reconciling statements and transactions to ensure that all business units are on the same page financially. Part 4 of the cost of production report requires you to compute the costs accounted for, also called the cost reconciliation schedule.

Bank Statement Reconciliation FAQs

It can also help build trust, confidence, and satisfaction among the stakeholders, and resolve any potential issues or conflicts that may arise from the cost reconciliation process. This means that the cost reconciliation process should be supported by appropriate tools and systems that can facilitate the collection, verification, analysis, and reporting of cost data. For example, the use of spreadsheets, databases, software, and applications that can perform calculations, validations, reconciliations, and adjustments of cost data automatically and accurately. This can help reduce the manual work, human errors, and inconsistencies that may occur in the cost reconciliation process. It can also help improve the speed, accuracy, and quality of the cost reconciliation results and reports. Investigating discrepancies and conducting root cause analysis can help improve the cost reconciliation process and ensure the accuracy and reliability of the cost data.

How to Overcome the Obstacles and Risks of Cost Reconciliation?

Understanding the importance of cost reconciliation can spotlight how essential it is for business operations. Without reconciling costs, businesses may run the risk of operating from incorrect financial information, leading to the potential for mismanagement of funds. We can combine cost and financial accounts, decreasing the costs with manual reconciliation. These solutions allow users to link cost accounts using algorithmic logic or automated processes within financial systems, dramatically increasing data reliability right away. Data connectivity solutions provide a powerful tool to keep cost and financial accounts in sync. By implementing such systems, businesses can significantly improve the accuracy and efficiency of data-driven decisions.

- Incorporating these strategies into your reconciliation process not only simplifies the task but also enhances the accuracy and efficiency of your financial management.

- Balances adjusting with third parties regularly, and accountants with experience, we can have an objective view of the data.

- This statement helps identify discrepancies between the two accounting systems, ensuring the accuracy of financial data.

- It is used to determine the cost per equivalent unit in a production process.

- By performing reconciliations against the general ledger, the company can ensure that its financial records are accurate and up-to-date.

- These different types of reconciliation are important for maintaining accurate financial records, detecting errors and fraud, and ensuring the reliability of the accounting system.

The cost of the products initially in the beginning WIP need to be added in since in the FIFO method, we had not yet accounted for those costs. With over a decade of experience working in construction software, Alex has worked with a number of Tier 1 international construction firms to aid their digital transformation. A CVR compares the cost of work to the actual work delivered within the project-to-date.

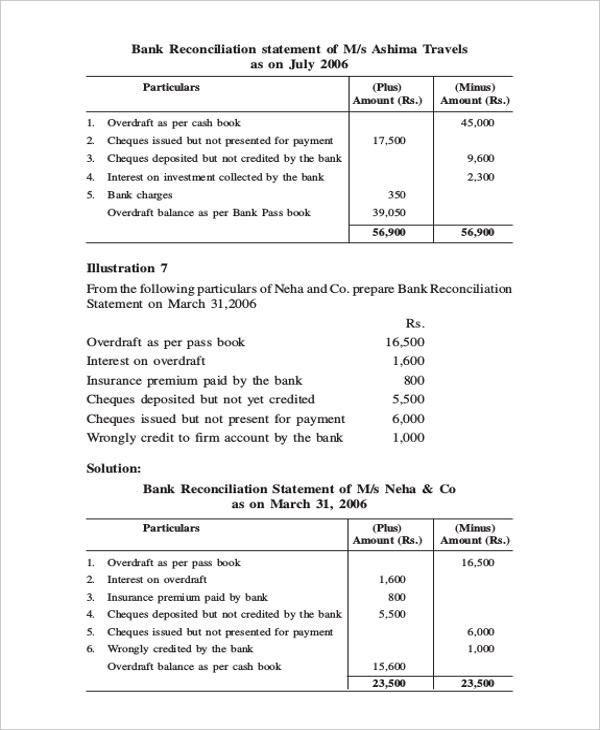

For instance, while performing an account reconciliation for a credit card clearing account, it may be noted that the general ledger balance is $260,000. Still, the supporting documentation (i.e., credit card processing statement) has a balance of $300,000. Further analysis may reveal that multiple transactions were improperly excluded from the general ledger but were adequately included in the credit card processing statement.

Construction analytics software makes it easier for teams to perform cost value reconciliation and reporting more frequently, so a lack of time or resources doesn’t become a reason to ignore financial risks. Suppose a company budgeted \( \$2000 \) for office supplies for a month, yet the actual expense came to \( \$2500 \). Through cost reconciliation, this discrepancy can be identified and explained, such as by a price increase in supplies, allowing the company to adjust future budgets accordingly. Not only does it boost the accuracy of cost and financial reports, but with an integrated accounting system, mistakes can be prevented from the source itself. Automated reconciliation also reduces costs and inefficiencies while minimizing human error on financial tasks. Having access to a diverse set of data sources is essential for any organization.

If you’ve written a check to a vendor and reduced your account balance in your internal systems accordingly, your bank might show a higher balance until the check hits your account. Similarly, if you were expecting an electronic payment in one month, but it didn’t actually clear until a day before or after the end of the month, this could cause a discrepancy. For example, real estate investment company ABC purchases approximately five buildings per fiscal year based on previous activity levels.

Analyzing capital accounts by transaction, this reconciliation includes beginning balances, additions, subtractions, and adjustments to match general ledger ending balances for capital accounts. It covers aspects like common stock par value, paid-in capital, and treasury share transactions. The problem will provide the information related to beginning work in process inventory costs and units. On a different note, if you’re looking for tools that simplify complex tasks like reconciliation, Bricks might be worth exploring.

Business intelligence tools are the bedrock upon which companies build their strategies for data… Debt consolidation is a process of combining multiple debtors’ debts into one compact, manageable… Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Recent comments